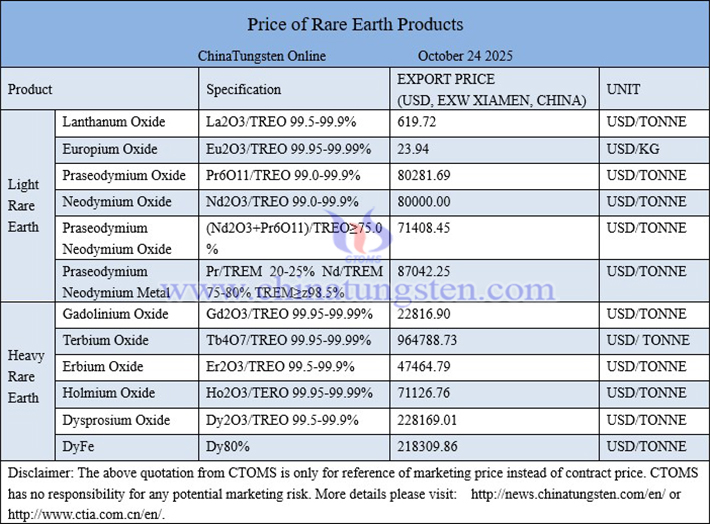

Rare earth market update on October 24, 2025

This week, domestic rare earth prices overall continued the downward trend from last week, though the decline has narrowed compared to the previous week. From the perspective of bullish factors, firstly, the significant price drop after the National Day holiday has boosted the enthusiasm of many downstream users to purchase at lower prices; secondly, as the prices of some products approach the cost line, suppliers are increasingly motivated to protect profits, reducing their willingness to lower prices for shipments; thirdly, the positive development trends in downstream rare earth industries such as robotics and wind power generation provide support for a potential market recovery. From the perspective of bearish factors, firstly, the escalation of rare earth export controls is unfavorable for increasing China's export volumes; secondly, influenced by traders' "buy on rise, not on fall" mentality and tight funding among many downstream production enterprises, market demand remains low.

According to CTIA GROUP LTD Online, this week, the price of praseodymium-neodymium oxide decreased by approximately RMB 13,000 per ton, a decline of 2.50%; praseodymium-neodymium metal decreased by approximately RMB 17,000 per ton, a decline of 2.68%; terbium oxide decreased by approximately RMB 150,000 per ton, a decline of 2.14%; 55N neodymium-iron-boron blank prices decreased by approximately RMB 8 per kilogram, a decline of 3.04%; and neodymium-iron-boron scrap (praseodymium-neodymium) prices decreased by approximately RMB 5 per kilogram, a decline of 0.92%. This indicates that the price declines for mainstream light rare earth and heavy rare earth series products this week are largely similar.

In terms of news, Guangsheng Nonferrous Metals expects to achieve a net profit attributable to shareholders of the parent company (NPASP) of RMB 100 million to RMB 130 million for the first three quarters of 2025, an increase of RMB 375.5232 million to RMB 405.5232 million compared to the same period last year. The expected non-recurring profit and loss-adjusted net profit is RMB 120.5474 million to RMB 150.5474 million, an increase of RMB 404.8068 million to RMB 434.8068 million compared to the same period last year.

Price of rare earth products on October 24, 2025

Neodymium oxide picture