Analysis of Latest Tungsten Market from Chinatungsten Online

The tungsten market remained generally upward this week. Tungsten raw material prices remained firm, primarily driven by price increases for long-term purchases by tungsten companies and market sentiment, providing significant cost support for the industry chain. Tungsten product manufacturers, including cemented carbide, passively raised product prices to maintain profit margins. Downstream end-users maintained a strategy of replenishing inventory based on demand, with limited purchasing activity. Supply and demand in the tungsten market continued to oscillate, and overall trading sentiment remained cautious.

In the tungsten concentrate market, suppliers were reluctant to sell at low prices, creating a tight supply and high prices.

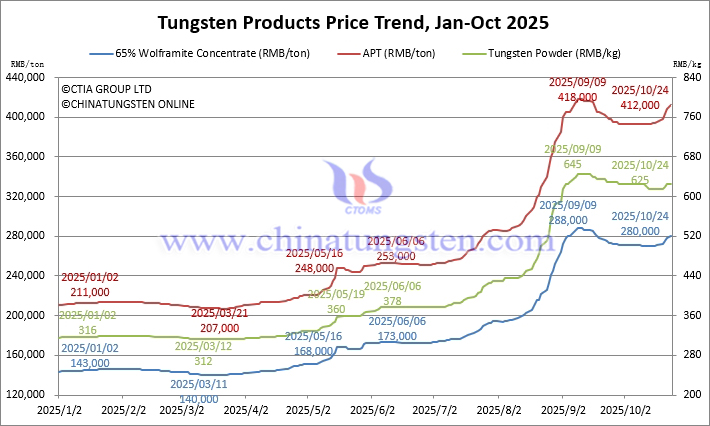

The price of 65% wolframite concentrate was reported at RMB 280,000/ton, up 3.3% week-on-week and 95.8% year-on-year.

The price of 65% scheelite concentrate was reported at RMB 279,000/ton, up 3.3% week-on-week and 96.5% year-on-year.

In the ammonium paratungstate (APT) market, significant cost support and limited resource release have strengthened sellers' bargaining power.

The price of ammonium paratungstate was reported at RMB 412,000/ton, up 4.3% week-on-week and 95.3% from the beginning of the year.

The European APT price was reported at USD 600-685/mtu (equivalent to RMB 378,000-432,000/ton), up 1.2% week-on-week and 94.7% from the beginning of the year.

In the tungsten powder market, high raw material costs and cautious downstream consumption led to demand-based transactions, resulting in a widening price spread.

The price of tungsten powder was reported at RMB 625/kg, up 1.6% week-on-week and 97.8% from the beginning of the year.

The price of tungsten carbide powder was reported at RMB 610/kg, up 1.7% week-on-week and 96.1% from the beginning of the year.

In the cobalt market, speculation continued due to tight supply, but consumer demand pressure was high, resulting in light trading.

The price of cobalt powder was reported at RMB 490/kg, up 8.9% week-on-week and 188.2% from the beginning of the year.

In the ferrotungsten market, there's a divergence between bullish sentiment from upstream and cautious sentiment from downstream, with manufacturers taking a wait-and-see approach and the market stagnating.

The price of 70% ferrotungsten is reported at RMB 388,000/ton, up 1.6% week-on-week and 80.5% since the beginning of the year.

The European ferrotungsten price is reported at USD 87-88.5/kg W (RMB 434,000-441,000/ton), unchanged week-on-week but with a narrowing price range. It is up 99.4% since the beginning of the year.

In the tungsten waste and scrap market, traders' confidence was mixed, and spot buying and selling activity cooled slightly, limiting price fluctuations.

The price of scrap tungsten bars is reported at RMB 425/kg, up 1.2% week-on-week and 93.2% since the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 410/kg, up 2.5% week-on-week and 79.8% since the beginning of the year.

Prices of Tungsten Products on October 24, 2025

Tungsten Price Trend from January to October 24, 2025