Analysis of Latest Tungsten Market from Chinatungsten Online

The tungsten market is generally stable. Recovering sentiment on the raw material side is driving a tightening supply and a price rebound. However, there has been no significant improvement in demand, and actual market transactions are still driven by rigid demand. Participants across the industry chain generally maintain a cautious attitude.

In the tungsten concentrate market, a bullish sentiment remains dominant, but actual rigid demand transactions are limited.

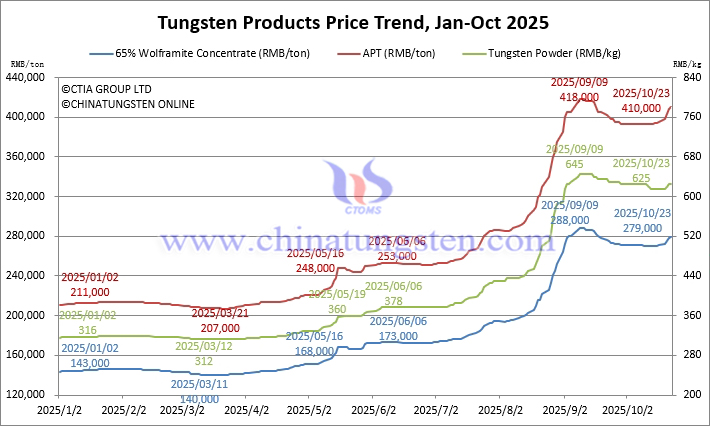

The price of 65% wolframite concentrate was reported at RMB 279,000/ton, down 3.1% from its high this year and up 95.1% from the beginning of the year.

The price of 65% scheelite concentrate was reported at RMB 278,000/ton, down 3.1% from its high this year and up 95.8% from the beginning of the year.

In the ammonium paratungstate market, cost and supply support have strengthened, with prices shifting upward. Demand remains cautious, and retail trading liquidity is limited.

The price of ammonium paratungstate (APT) was reported at RMB 410,000/ton, down 1.9% from its high this year and up 94.3% from the beginning of the year.

European APT prices are reported at USD 600-685/mtu (RMB 378,000-432,000/ton), up 94.7% from the beginning of the year.

In the tungsten powder market, supply and demand are poorly matched, buyers are reluctant to stock up, and transactions continue to be negotiated on a case-by-case basis.

Tungsten powder prices are reported at RMB 625/kg, down 3.1% from the year's high and up 97.8% from the beginning of the year.

Tungsten carbide powder prices are reported at RMB 610/kg, down 3.2% from the year's high and up 96.1% from the beginning of the year.

Cobalt powder prices are reported at RMB 490/kg, up 188.2% from the beginning of the year.

In the ferrotungsten market, cost factors are providing stronger support, while demand factors are mediocre, leading to a stable spot market.

70 ferrotungsten prices are reported at RMB 388,000/ton, down 5.4% from the year's high and up 80.5% from the beginning of the year.

European ferrotungsten prices are reported at USD 86-89.5/kg W (RMB 429,000-446,000/ton), a 99.4% increase from the beginning of the year.

In the tungsten waste and scrap market, prices have risen slightly in line with the raw material market, but after earlier restocking, traders' capital incentives have weakened, leading to cautious trading.

The price of scrap tungsten bars is reported at RMB 425/kg, down 4.5% from its peak this year and up 93.2% from the beginning of the year.

The price of scrap tungsten drill bits is reported at RMB 410/kg, down 9.9% from its peak this year and up 79.8% from the beginning of the year.

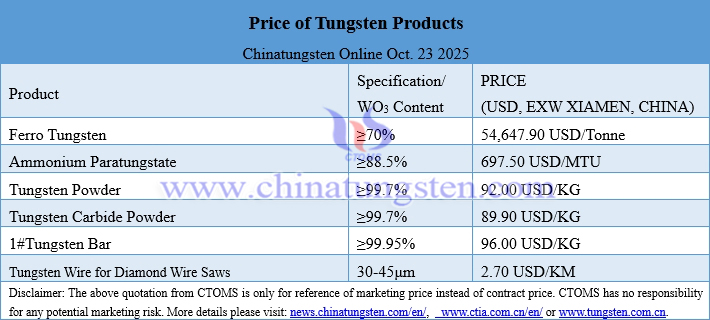

Prices of Tungsten Products on October 23, 2025

Tungsten Price Trend from January to October 23, 2025