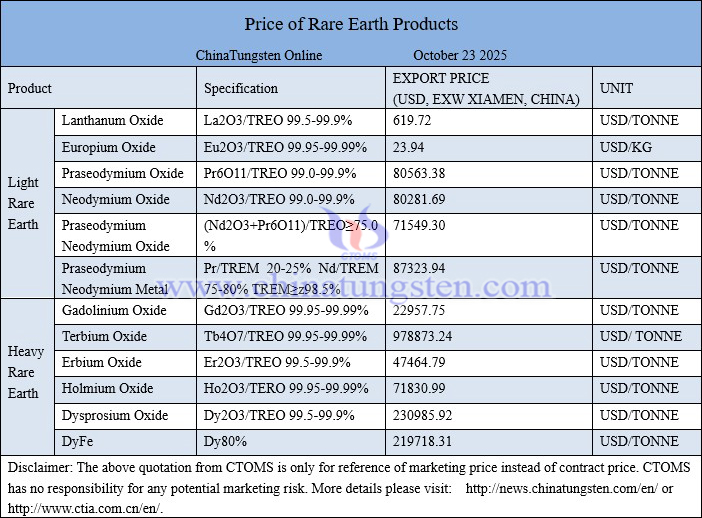

Rare earth market update on October 23, 2025

The domestic rare earth market overall maintains stable operation, with a mix of bullish and bearish factors leading traders to focus on rigid transactions, resulting in moderate market activity and temporarily stable product prices. Under these conditions, some industry players predict that the rare earth market may continue to trade sideways in the short term. Today, the prices of praseodymium-neodymium oxide, gadolinium oxide, and dysprosium oxide are approximately RMB 570,000 per ton, RMB 163,000 per ton, and RMB 1,640,000 per ton, respectively.

In the light rare earth market, influenced by increased inquiries from downstream magnetic material enterprises and stronger production cost support, praseodymium-neodymium prices have shown signs of stabilizing after a decline. However, terminal demand release remains insufficient, prompting traders to adopt cautious operational strategies. In the medium and heavy rare earth market, the situation remains lukewarm, with product prices fluctuating within a reasonable range amid limited supplier price concessions and insufficient consumer purchasing power among downstream users.

In terms of news, Shenghe Resources expects to achieve a net profit attributable to shareholders of the parent company (NPASP) of RMB 740 million to RMB 820 million for the first three quarters of 2025, an increase of RMB 647.1304 million to RMB 727.1304 million compared to the same period last year, representing a year-on-year increase of 696.82% to 782.96%. The expected non-recurring profit and loss-adjusted net profit is RMB 726.50 million to RMB 806.50 million, an increase of RMB 642.9044 million to RMB 722.9044 million compared to the same period last year, representing a year-on-year increase of 769.06% to 864.76%.

Price of rare earth products on October 23, 2025

Neodymium oxide picture