The tungsten market is showing a strong performance, primarily driven by positive sentiment on the mining and smelting sides. Tungsten raw material resources are tight, leading to rising prices for major tungsten products. Buyers, however, maintain a cautious, on-demand inventory replenishment strategy, resulting in a subdued trading atmosphere.

The cobalt market remains robust, with supply gaps and speculative activity caused by export quotas in major supplying countries supporting continued price increases. The price of cobalt powder doubled this year in late September and is now close to doubling this year just one month later.

Due to the difficulty in absorbing the cost pressures brought on by the successive increases in tungsten and cobalt raw material prices, cemented carbide manufacturers are experiencing another wave of price increases. Small and medium-sized alloy manufacturers lacking strong financial resources or product specialization are facing severe operational challenges.

The tungsten scrap market has recently seen a slight increase, but overall trading activity has declined slightly. This is partly due to holders' reluctance to sell, anticipating price increases, and partly due to buyers' cautious bargaining attitude, leading to an overall wait-and-see attitude in the market.

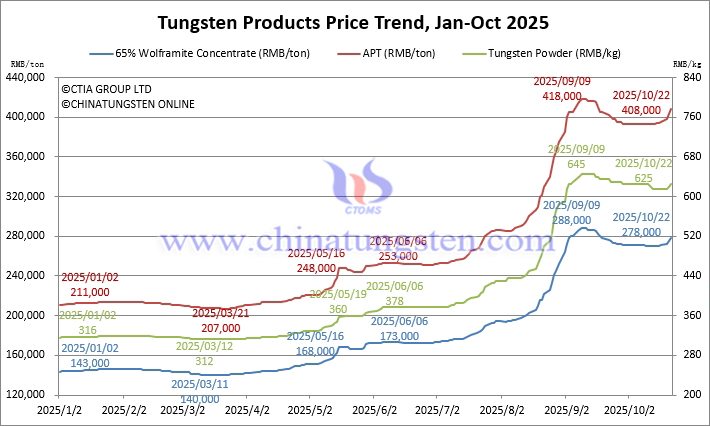

As of press time,

The price of 65% wolframite concentrate was RMB 278,000/ton, down 3.5% from its peak this year and up 94.4% from the beginning of the year.

The price of 65% scheelite concentrate was RMB 277,000/ton, down 3.5% from its peak this year and up 95.1% from the beginning of the year.

The price of ammonium paratungstate (APT) was RMB 408,000/ton, down 2.4% from its peak this year and up 93.4% from the beginning of the year.

The price of APT in Europe was USD 600-685/mtu (RMB 378,000-432,000/ton), up 94.7% from the beginning of the year.

The price of tungsten powder was RMB 625/kg, down 3.1% from its peak this year and up 97.8% from the beginning of the year.

The price of tungsten carbide powder was RMB 610/kg, down 3.2% from its peak this year and up 96.1% from the beginning of the year.

The price of cobalt powder was RMB 490/kg, up 188.2% from the beginning of the year.

The price of 70 ferrotungsten was RMB 388,000/ton, down 5.4% from its peak this year and up 80.5% from the beginning of the year.

The price of European ferrotungsten was USD 86-89.5/kg W (equivalent to RMB 429,000-446,000/ton), up 99.4% from the beginning of the year.

The price of scrap tungsten rod was RMB 425/kg, down 4.5% from its peak this year and up 93.2% from the beginning of the year.

The price of scrap tungsten drill bits was RMB 410/kg, down 9.9% from its peak this year and up 79.8% from the beginning of the year.

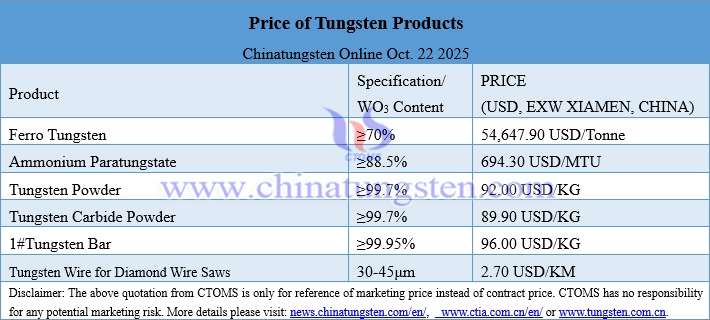

Prices of Tungsten Products on October 22, 2025

Tungsten Price Trend from January to October 22, 2025