Molybdenum market update on October 22, 2025

The domestic molybdenum market has generally shown a trend of retracing from high levels. Under the game pattern of bullish and bearish factors, the buyer's market holds a relatively significant advantage, mainly reflected in the price decline of most products to varying degrees and the shrinkage of actual trading volume. Today, the prices of molybdenum concentrate and ferromolybdenum decreased by approximately RMB 20/ton-degree and RMB 1,000/ton respectively.

In the molybdenum concentrate market, the purchasing and selling atmosphere remains sluggish, mainly attributed to the weakened willingness of downstream users to take delivery and the limited price concession space of suppliers. It is noteworthy that the recent accelerated decline in international molybdenum prices is not conducive for molybdenum mining enterprises to maintain firm quotations.

In the ferromolybdenum market, although some steel enterprises are still willing to enter the market for bidding and production costs provide strong support for prices, the transmission pressure brought by the decline in steel bidding prices has significantly offset the above-mentioned supporting effects, with ferromolybdenum quotations falling to around RMB 283,000/ton. Recently, the steel enterprises that have entered the market to bid for ferromolybdenum include Dongfang Special Steel, POSCO (Zhangjiagang), Shanxi Taigang Stainless Steel, Nanjing Iron and Steel, Dalian Special Steel, Deyang Erzhong Heavy Industry, etc.

In the molybdenum chemical and products market, the overall market situation has not shown obvious changes. End customers continue to adopt the on-demand procurement strategy, while holders of goods dynamically adjust their quotations in line with the fluctuations of raw material prices. Today, the prices of molybdate products generally decreased by RMB 1,000/ton.

In terms of news, data from the National Bureau of Statistics shows that in the third quarter of 2025, the capacity utilization rate of industrial enterprises above designated size nationwide was 74.6%, which increased by 0.6 percentage points compared with the second quarter and decreased by 0.5 percentage points compared with the same period last year. Among them, the capacity utilization rate of the chemical raw materials and chemical products manufacturing industry was 72.5%, the non-metallic mineral products industry was 62.0%, the ferrous metal smelting and rolling processing industry was 80.1%, the non-ferrous metal smelting and rolling processing industry was 77.8%, the general equipment manufacturing industry was 78.9%, the special equipment manufacturing industry was 75.5%, the automobile manufacturing industry was 73.3%, the electrical machinery and equipment manufacturing industry was 74.9%, and the computer, communication and other electronic equipment manufacturing industry was 79.0%.

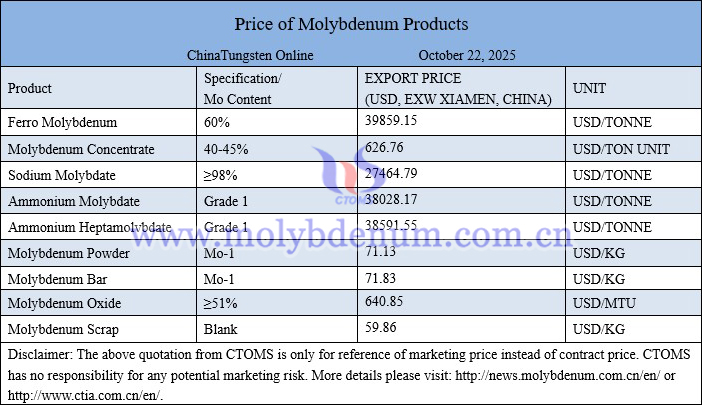

Price of molybdenum products on October 22, 2025

Molybdenum copper sheet picture