Molybdenum market update on October 20, 2025

On Monday, the domestic molybdenum market operated stably overall. After the volatile increase in molybdenum product prices last week, downstream users' fear of high prices generally intensified, which to a certain extent weakened suppliers' confidence in raising prices. Coupled with the impact of the correction in international molybdenum prices from high levels, the upward space for domestic molybdenum prices was further constrained. Today, the prices of molybdenum concentrate, ferromolybdenum and ammonium heptamolybdate consolidated at around RMB 4,470 per ton-unit, RMB 285,000 per ton and RMB 275,000 per ton respectively. However, in the long run, factors such as the limited increase in spot supply of raw materials, the promising development prospects of the downstream molybdenum industry, and the increasingly prominent status of strategic metals still support most insiders to hold an optimistic expectation for the subsequent trend of the molybdenum market.

In terms of news, data from the National Bureau of Statistics showed that in September 2025, the national producer price index (PPI) decreased by 2.3% year-on-year; the producer purchase price index decreased by 3.1% year-on-year. Among them, in the producer price index, the price of the mining industry decreased by 9.0%, the price of the raw material industry decreased by 2.9%, and the price of the processing industry decreased by 1.7%; in the producer purchase price index, the price of chemical raw materials decreased by 5.5%, the price of building materials and non-metals decreased by 4.5%, the price of ferrous metal materials decreased by 2.9%, and the price of non-ferrous metal materials and wires increased by 6.6%.

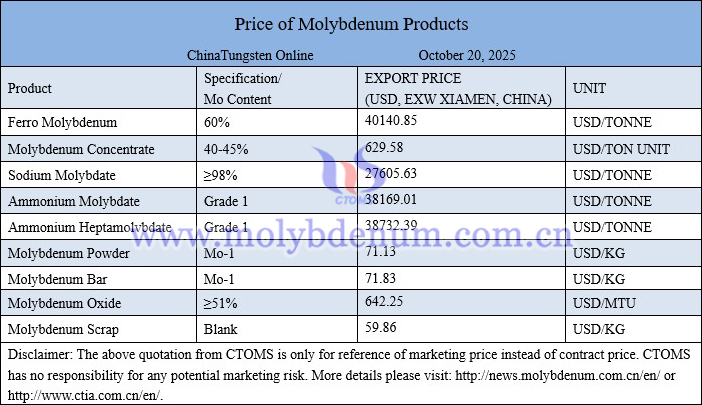

Price of molybdenum products on October 20, 2025

White molybdenum wire picture