Analysis of Latest Tungsten Market from Chinatungsten Online

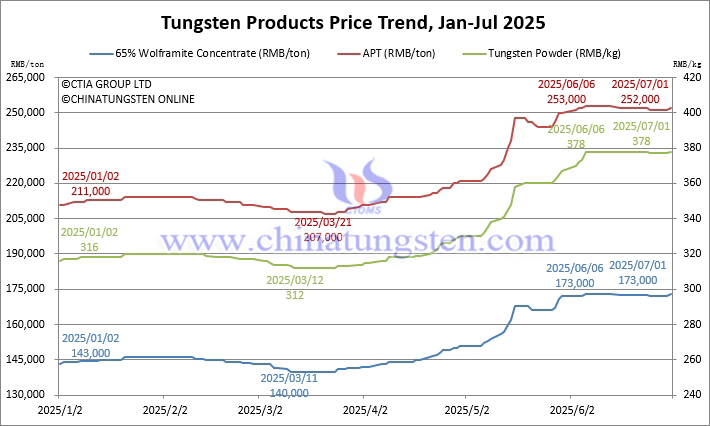

In the first half of 2025, the price of tungsten ended with an increase of about 20% (end of June/early the year). At the beginning of the second half of the year, the tungsten market sentiment rose again.

In addition to the traditional supply and demand relationship, the main supporting factors for recent market sentiment are four: (1) The tungsten ore side is reluctant to sell and support the market, and the scarcity of market goods maintains price rigidity; (2) The strong international APT price has increased by more than 40% in the first half of 2025; (3) The rational adjustment of tungsten raw material prices in the second half of June releases some high-level risks, promoting the implementation of some urgent needs; (4) After some deep processing enterprises consume inventory, they have to supplement raw materials as needed. Traders therefore tried to make a quotation upwards.

However, downstream end users are still confined to the contradiction between cost and demand, their procurement strategies are conservative, back-to-back transactions are the main, and the actual market order implementation is limited.

The price of 65% wolframite concentrate was RMB 173,000/ton, and the psychological price of some suppliers reached 175,000/ton, but it was difficult to complete a high-level transaction, and the buyer and seller still remained stalemate in negotiations.

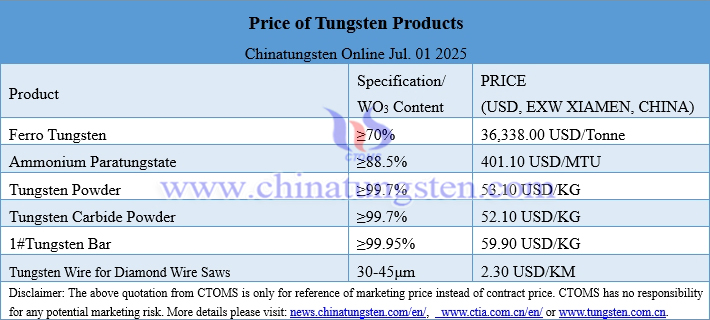

The price of ammonium paratungstate (APT) is RMB 252,000/ton, and the market liquidity is shrinking. The price level is based on the performance of the market cost side and the long-order purchase prices of several representative tungsten companies.

The price of tungsten powder is RMB 378/kg, and the price of tungsten carbide powder is RMB 370/kg. The market cost pressure is high, but the transmission to the downstream is hindered. Powder metallurgical companies have limited new orders and are cautious in managing inventory.

The price of 70 ferrotungsten is RMB 258,000/ton, and the market is in a sideways consolidation stage. The pricing logic is based on costs, actual demand and international market conditions, and the market is full of wait-and-see sentiment.

The price of waste tungsten remains sideways, the firmness of the tungsten raw material end and the strategic attributes of resource provide relatively stable value support and psychological expectations for tungsten waste, and market bargaining is relatively stable.

Prices of Tungsten Products on July 1, 2025

Tungsten Price Trend from January to July 1, 2025